Global Currency Scalper

We are Global Currency Scalpers, bringing you one of our three successful trading strategies. Centered on scalping of the Forex market. We realize that 65% of Forex traders lose money, some estimate it's as high as 90% of Forex traders lose money. At Global Currency Scalper we run three very successful and time proven trading strategies. This blog is intended to bring you one of those strategies with live Scalping updates. Don't be one of the Forex markets statistics!

Thursday, September 24, 2015

New EURNZD Signal

As of 09/24/2015 at 8:20 EST

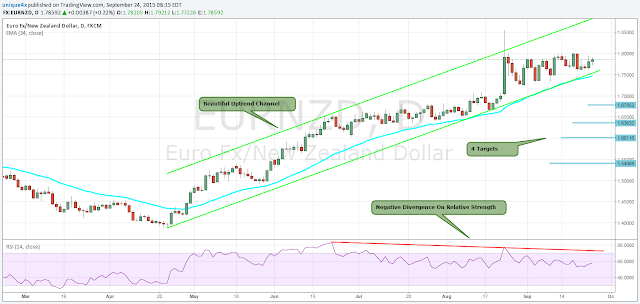

The Global Currency Scalper has identified a possible Short trade in EURNZD.

EURNZD is setting up for a possible bearish move down to any of the 3 targets listed below. Although this pair has been in a beautiful uptrend over the past 5 months, it will end sooner or later. RSI has been flashing some negative divergence for 3 months, that alone is not enough to act upon. We will be waiting to see a daily close below the lower uptrend line by more than 50 Pips before initiating our swing position.

Targets are listed in blue at 1.67852, 1.63632, 1.60116 and 1.54088. Stop can be placed with a daily close above 1.80070 or if you'd like to risk more, a daily close above the upper trendline.

Monday, September 21, 2015

New AUDNZD Signal

As of 09/21/2015 at 08:34 EST:

The Global Currency Trader has identified a possible Long trade in AUDNZD.

AUDNZD is forming a solid triangle pattern on the hourly chart. If you back out and look at the daily chart you find this pair is in a long-term uptrend which will favor a move out of this triangle pattern to the upside. We will be looking for a close above the upper trendline before initiating our position.

Targets will be 1.13700 and the figure of 1.14000. Our stop will be place with a break of the lower trendline which at this time is approximately 90 Pips. If this pair closes below the lower trendline before we can initiate our position the signal will be null and void.

Monday, September 14, 2015

New GBPUSD Signal

After a series of bullish breakouts, the GBPUSD closed the week with the creation of an inside bar. If currency price action closes “inside” of the reference candles high and low, traders may begin looking for a breakout at the start of next week’s trading. Resistance is market with Thursday high at 1.5476, and a breakout above this value would be considered a bullish on the creation of a new higher high. Conversely bearish breakouts begin below support found at 1.53370. A move below this point suggests that the pair may be developing a new bearish bias. In the event of either a bullish or bearish breakout, ATR can be used to project potential profit targets. Current daily ATR equals 117 pips and can be added to an entry in either scenario.

In the event that prices fail to breakout above or below the high and low set by the reference candle, this suggests that the GBPUSD will continue to consolidate inside of support and resistance. In this instance, it would tentatively delay the execution of any breakout based entry orders.

New EURGBP Signal

EURGBP is forming a nice falling wedge pattern on the 4 hour. This should lead to a breakout to the upside and continue it's short-term trend higher.

We will be waiting for a close above the top trendline, assuming we get that close we will then initiate our long position. Targets will be 0.7400, 0.74500 and 0.75000. A close below the lower trendline will make the signal null and void.

Thursday, September 10, 2015

New EURAUD Signal

As of 09/10/2015 at 9:00 EST

The Global Currency Scalper has identified a possible Long trade in EURAUD.

As you can see this pair is forming a triangle pattern on the 4 hour timeframe. With the long-term trend on the daily being to the upside we will be looking to trade this pair with that in mind. Although we won't be afraid to take a short position, current trends tell us to lean towards the long side. When looking at the hourly chart you can see this triangle forming on the 4 hour and that the pair has recently traded down towards the lower end of that triangle. With a short-term down trendline drawn in red we will be looking for a close above this short-term trendlind before initiating a long position.

Once our long position is initiated this pair could very easily make a run back up towards the top of the triangle on the 4 hour. Our profit targets will be 1.60340, 1.61200 and 1.63700 if the top trendline of the triangle is taken out with conviction. Our stop will be placed at 1.57700, possibly as low as 1.57400.

Wednesday, September 9, 2015

New GBPUSD Signal

As of 09/09/2015 at 14:00 EST

The Global Currency Scalper has identified a possible Long trade in GBPUSD.

GBPUSD is forming a nice triangle on the 30 min chart. With a close above the top trendline and our algorithm confirming a run higher we will be taking a long position. If this pair closes below the lower trendline of the triangle the signal will be null and void.

We suggest waiting for our algorithm to give the green light, as of this writing it's showing a consolidation towards the triangle's apex.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

nyc,

options,

pips,

stock market,

stocks,

trading,

uk,

wall street

Tuesday, September 8, 2015

New USDCAD Signal

As of 09/08/2015 at 18:30 EST:

The Global Currency Scalper is looking to Buy USDCAD

We are looking for the USDCAD to continue it's recent uptrend. On the 4 hour chart it's forming a nice triangle pattern, we would like to see a close above this triangle before initiating our long position.

Targets will be the figure of 1.34000, 1.34500 and the figure of 1.35000. Our stop will be placed with a break of the lower trendline of this triangle. If this pair closes below the lower trendline of the triangle the signal will be null and void.

Subscribe to:

Comments (Atom)