We are Global Currency Scalpers, bringing you one of our three successful trading strategies. Centered on scalping of the Forex market. We realize that 65% of Forex traders lose money, some estimate it's as high as 90% of Forex traders lose money. At Global Currency Scalper we run three very successful and time proven trading strategies. This blog is intended to bring you one of those strategies with live Scalping updates. Don't be one of the Forex markets statistics!

Thursday, September 24, 2015

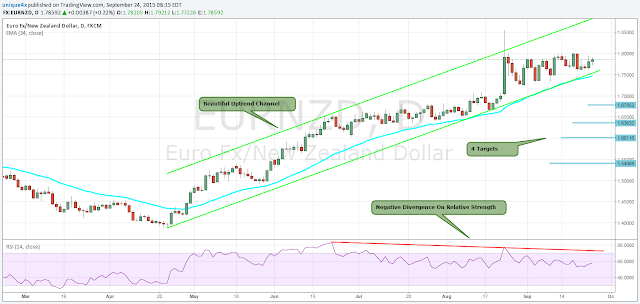

New EURNZD Signal

As of 09/24/2015 at 8:20 EST

The Global Currency Scalper has identified a possible Short trade in EURNZD.

EURNZD is setting up for a possible bearish move down to any of the 3 targets listed below. Although this pair has been in a beautiful uptrend over the past 5 months, it will end sooner or later. RSI has been flashing some negative divergence for 3 months, that alone is not enough to act upon. We will be waiting to see a daily close below the lower uptrend line by more than 50 Pips before initiating our swing position.

Targets are listed in blue at 1.67852, 1.63632, 1.60116 and 1.54088. Stop can be placed with a daily close above 1.80070 or if you'd like to risk more, a daily close above the upper trendline.

Monday, September 21, 2015

New AUDNZD Signal

As of 09/21/2015 at 08:34 EST:

The Global Currency Trader has identified a possible Long trade in AUDNZD.

AUDNZD is forming a solid triangle pattern on the hourly chart. If you back out and look at the daily chart you find this pair is in a long-term uptrend which will favor a move out of this triangle pattern to the upside. We will be looking for a close above the upper trendline before initiating our position.

Targets will be 1.13700 and the figure of 1.14000. Our stop will be place with a break of the lower trendline which at this time is approximately 90 Pips. If this pair closes below the lower trendline before we can initiate our position the signal will be null and void.

Monday, September 14, 2015

New GBPUSD Signal

After a series of bullish breakouts, the GBPUSD closed the week with the creation of an inside bar. If currency price action closes “inside” of the reference candles high and low, traders may begin looking for a breakout at the start of next week’s trading. Resistance is market with Thursday high at 1.5476, and a breakout above this value would be considered a bullish on the creation of a new higher high. Conversely bearish breakouts begin below support found at 1.53370. A move below this point suggests that the pair may be developing a new bearish bias. In the event of either a bullish or bearish breakout, ATR can be used to project potential profit targets. Current daily ATR equals 117 pips and can be added to an entry in either scenario.

In the event that prices fail to breakout above or below the high and low set by the reference candle, this suggests that the GBPUSD will continue to consolidate inside of support and resistance. In this instance, it would tentatively delay the execution of any breakout based entry orders.

New EURGBP Signal

EURGBP is forming a nice falling wedge pattern on the 4 hour. This should lead to a breakout to the upside and continue it's short-term trend higher.

We will be waiting for a close above the top trendline, assuming we get that close we will then initiate our long position. Targets will be 0.7400, 0.74500 and 0.75000. A close below the lower trendline will make the signal null and void.

Thursday, September 10, 2015

New EURAUD Signal

As of 09/10/2015 at 9:00 EST

The Global Currency Scalper has identified a possible Long trade in EURAUD.

As you can see this pair is forming a triangle pattern on the 4 hour timeframe. With the long-term trend on the daily being to the upside we will be looking to trade this pair with that in mind. Although we won't be afraid to take a short position, current trends tell us to lean towards the long side. When looking at the hourly chart you can see this triangle forming on the 4 hour and that the pair has recently traded down towards the lower end of that triangle. With a short-term down trendline drawn in red we will be looking for a close above this short-term trendlind before initiating a long position.

Once our long position is initiated this pair could very easily make a run back up towards the top of the triangle on the 4 hour. Our profit targets will be 1.60340, 1.61200 and 1.63700 if the top trendline of the triangle is taken out with conviction. Our stop will be placed at 1.57700, possibly as low as 1.57400.

Wednesday, September 9, 2015

New GBPUSD Signal

As of 09/09/2015 at 14:00 EST

The Global Currency Scalper has identified a possible Long trade in GBPUSD.

GBPUSD is forming a nice triangle on the 30 min chart. With a close above the top trendline and our algorithm confirming a run higher we will be taking a long position. If this pair closes below the lower trendline of the triangle the signal will be null and void.

We suggest waiting for our algorithm to give the green light, as of this writing it's showing a consolidation towards the triangle's apex.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

nyc,

options,

pips,

stock market,

stocks,

trading,

uk,

wall street

Tuesday, September 8, 2015

New USDCAD Signal

As of 09/08/2015 at 18:30 EST:

The Global Currency Scalper is looking to Buy USDCAD

We are looking for the USDCAD to continue it's recent uptrend. On the 4 hour chart it's forming a nice triangle pattern, we would like to see a close above this triangle before initiating our long position.

Targets will be the figure of 1.34000, 1.34500 and the figure of 1.35000. Our stop will be placed with a break of the lower trendline of this triangle. If this pair closes below the lower trendline of the triangle the signal will be null and void.

Thursday, September 3, 2015

New GBPUSD Signal

As of 09/03/2015 at 16:00 EST

The Global Currency Scalper has identified a possible short trade in GBPUSD.

GBPUSD has been in a downtrend over the past few days and clearly the hourly chart is following suit. As you can see there have been three corrective moves over the course of this downtrend. Each of these three corrective moves spanned 51 - 102 Pips.

When corrective moves are limited to less than 20% of the total move it is showing that sellers are in control. Again as you can see the biggest corrective move of 102 pips was 17% of the total move while the other two ranged from 8.5% - 11.3%. Sellers are obviously in control.

We will be waiting for another corrective move of between 51 - 102 Pips, currently having a short entry target of 1.52900 - 1.53250. This can very easily change if this pair sets a new low before giving us the corrective move we're looking for, with that said we are willing to adjust our short entry target if needed.

Targets will be 1.51750, 1.51000 and 1.50300. Our stop will be 1.54500.

Tuesday, September 1, 2015

New EURUSD Signal

As of 09/01/2015 at 13:55 EST:

The Global Currency Scalper has identified a possible Short trade in EURUSD.

We will be watching EURUSD for a breakout of this Triangle pattern to the downside. This is an emerging pattern with high probability. Wait for a close on the 30 minute chart below the lower trendline of this triangle pattern before initiating a position. Targets of 1.11500 - 1.11700 and 1.11000.

If this pair breaks up through the upper trendline this signal will be null and void.

Monday, August 31, 2015

New EURGBP Signal

As of 08/31/2015 at 19:00 EST:

The Global Currency Scalper has identified a possible Short trade in EURGBP.

We will be watching EURGBP for a breakout of this Flag pattern to the downside. This is an emerging pattern with high probability. Wait for a close on the 30 minute chart below the lower trendline of this flag pattern before initiating a position. Targets of 0.72400 - 0.72500 and 0.72000.

If this pair breaks up through the upper trendline this signal will be null and void.

Thursday, August 27, 2015

New Signal USD/JPY

As of 08/27/2015 at 13:15 the Global Currency Scalper has recognized a possible short trade in USD/JPY on the 1H chart. It is forming a rising wedge pattern with a high probability trade if it can get triggered.

We will be waiting for a close below the lower trendline of this rising wedge before initiating a position. Targets will be 119.750, 119.500 and the figure of 119.000. If this pair trades above the upper trendline before initiating a position the signals becomes null and void.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

uk,

wall street

Wednesday, August 26, 2015

New Signal EUR/USD

As of 08/26/2015 at 21:30 EST:

The Global Currency Scalper has identified a possible Long trade in EURUSD.

We will be watching EURUSD for a breakout of this Flag pattern to the upside. This is an emerging pattern with high probability. Wait for a close on the 60 minute chart above the upper trendline of this flag pattern before initiating a position. Targets of 1.15200, 1.15600 and 1.16100.

If this pair breaks down through the lower trendline this signal will be null and void.

Tuesday, August 25, 2015

New Signal USDCHF

As of 08/25/2015 at 16:20 EST:

The Global Currency Scalper has identified a possible Short trade in USDCHF.

We will be watching USDCHF for a breakout of this Rising Wedge to the downside. This is an emerging pattern with high probability. Wait for a close on the 30 minute chart below the lower trendline of this rising wedge pattern before initiating a position. Targets of 0.93300, 0.93000 and 0.92500.

If this pair breaks up through the upper trendline this signal will be null and void.

Labels:

Bloomberg,

business,

currency,

economics,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

options,

pips,

stock market,

stocks,

trading,

wall street

New Signal CADCHF

As of 08/25/2015 at 12:35 EST:

The Global Currency Scalper has identified a possible Long trade on CADCHF.

We will be watching CADCHF for a breakout of this Triangle to the Downside. This is an emerging pattern with high probability. Wait for a close on the 30 minute chart below the lower trendline of this triangle pattern before initiating a position. Targets of 0.7000, 0.69850 and 0.69600.

If this pair breaks down through the lower trendline this signal will be null and void.

Labels:

Bloomberg,

business,

currency,

economics,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

wall street

New Signal EUR/USD

As of 08/25/2015 at 10:25 EST:

The Global Currency Scalper has identified a possible Long trade on EURUSD.

We will be watching EURUSD for a breakout of this flag to the upside. This is an emerging pattern with high probability. Wait for a close on the 30 minute chart for a close above the top trendline of this flag pattern before initiating a position. Targets of 1.15750, the figure of 1.16000 and 1.16200.

If this pair breaks down through the lower trendline this signal will be null and void.

Labels:

Bloomberg,

business,

currency,

economy,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

wall street

Friday, August 21, 2015

New EUR/CHF Signal

This pair is forming a very solid ABCD pattern as point C was put in place very decisively. The chart is showing the ABCD pattern overlaid with a Fibonacci Extension. Our projection is for this pair to make a run towards the 61.8% to 76.4% Fib extensions but we wouldn't be surprised if it made a run to the 100% level as the pullback was shallow. Pullbacks that do not retrace the entire 61.8% show that buyers are eager to resume the uptrend. As you can see the C retracement was only 56.9%. As long as the bulls stay in the Euro camp our projection could be met but as we all know the Euro has been in a long-term bear trend.

Set your stops just below point A, we will be willing to risk down to the 1.06900 level as our algorithm is calculating 90% odds of a run higher on the daily chart. www.unique4xpro.com

Thursday, August 20, 2015

EURUSD May Still Have Room To Run

EURUSD formed a solid ABCD pattern which is overlaid with a Fibonacci Extension. This pair could have room to run if it can get through the 76.4% Fib level followed by the 85.4% level. We should see EURUSD run to at least 100% Fib level which would bring this pair to the 1.13736 level. Considering the move from point B to point C was shallow at 54.4% compared to the expected 61.8% level shows that buyers we eager to resume the uptrend.

If you're still long we would recommend lightening up on your position at bare minimum around this 76.4% level. With the remaining position you could place your stop between break-even and just below point B depending on your aggressiveness.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

wall street

Wednesday, August 19, 2015

New Signal AUD/NZD

As of 08/19/2015 @ 23:25 EST:

The Global Currency Scalper has identified a Long opportunity in AUDNZD.

The AUDNZD pair is forming a solid Gartley pattern on the 4H chart. It's in the process of forming a bullish formation which we will be able to initiate a long trade at or near point D. This could take a day or two to unfold, if the pair decides to rally without coming down close to point D the order will be cancelled.

We will be looking to take this pair long at 1.10600 which also coincides to a congestion area from the end of July which should act as support along with the Gartley. Our stop will be on a break of point X by 10 - 20 Pips. With that said our stop will be 1.1000 which is also a big figure. Profit target will be 1.11200 - 1.11500.

New Signal AUD/JPY

As of 08/19/2015 @ 23:05 EST:

The Global Currency Scalper has identified a possible Long trade in AUD/JPY

The AUDJPY is forming a solid Gartley pattern on the 4H chart. It's in the process of forming a bullish formation which we will be able to initiate a long trade at or near point D. This could take a day or two to unfold, if the pair decides to rally without coming down close to point D the order will be cancelled.

We will be looking to take this pair long at 89.960 which also coincides close to the figure. You may want to consider placing an order to buy just ahead of the figure just in-case it bounces off the figure. Our stop will be on a break of point X by 10 - 20 Pips. With that said our stop will be 89.100. Profit target will be 91.200 - 91.500

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

uk,

wall street

Tuesday, August 18, 2015

Possible Long Setup In GBPNZD

As of 08/18/2015 at 20:55 EST:

The Global Currency Scalper has identified a possible Long trade in GBPNZD.

GBPNZD is in the midst of forming a Gartley pattern on the 1H chart. Keep an eye to see if this pair approaches point D, if so and can hold with a close near point D it may present a solid long opportunity. We would like to see our algorithm confirm a possible bounce off the D level before initiating a position.

Possible Long Trade In GBP/CAD

As of 08/18/2015 at 20:45 EST:

The Global Currency Scalper has identified a possible Long trade in GBPCAD.

GBPCAD is in the midst of forming a Gartley pattern on the 1H chart. Keep an eye to see if this pair approaches point D, if so and can hold with a close near point D it may present a solid long opportunity. We would like to see our algorithm confirm a possible bounce off the D level before initiating a position.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

wall street

Wednesday, August 5, 2015

New EURCAD Signal

As of 08/05/2015 @ 20:00 EST:

The Global Currency Scalper has identified a possible long trade in EUR/CAD.

The EURCAD is forming an ascending triangle on the 4H chart. This pairs success rate is 68% on the 4H and the ascending triangle has a 75% success rate for all pairs monitored by our algorithm. The top of the ascending triangle is close to the 38.2% Fib extension. When support or resistance lines up close with a Fib extension figure and that area is broken the moves tend to be quite strong.

We will be going long approximately 20 Pips above 1.44320, our profit target will be 1.45100 - 1.45800. Our stop will be set 1.42500.

Tuesday, August 4, 2015

New USDJPY Signal

As of 08/04/2015 @ 22:30 EST:

The Global Currency Scalper has identified a possible long trade in USDJPY.

USDJPY is forming an ascending triangle on the 4H chart. Although our algorithm only gives a 61% success rate for this pair on the 4H chart the pattern gives 75% success rate on all pairs monitored. Also with a close above the 38.2% Fibonacci extension coinciding with a breakout of the ascending triangle we will be looking to take a long position.

If this breakout occurs we will be long above 124.520 with targets of the figure 125.000, 125.400 and 126.000. We will be risking 100-150 pips at max.

New EURUSD Signal

As of 08/04/2015 @ 16:45 EST:

The Global Currency Scalper has recognized a descending triangle pattern on EURUSD.

The EURUSD is in the process of forming a descending triangle which we will be looking to short about 20 pips below the bottom of the triangle. According to our algorithm this pair has a 76% success rate on the daily chart when it recognizes a pattern. This pattern has a 76% success rate for all currency pairs which we monitor.

Our profit target will be 200-220 pips while our stop will be 180-200 pips.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

uk,

wall street

Monday, August 3, 2015

New Signal EURNZD

As of 08/03/2015 at 21:20 EST:

The Global Currency Scalper has identified a possible long trade in EURNZD.

The EURNZD is in the process of forming an ascending triangle on the 1H chart. This pair has a 69% success rate on the 1H chart and this ascending triangle pattern has a 80% success rate on all currency pairs our algorithm trades.

We will be buyers of this pair approximately 20 pips above the top line of the triangle. Our profit target will be 250-300 pips while our stop will be 140-180 pips.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

wall street

New Signal NZD/JPY

As of 08/03/2015 @ 20:55 EST:

The Global Currency Scalper has identified a short trade in NZD/JPY.

NZDJPY is in the process of forming a descending triangle. This pair has a success rate of 71% on the 1H chart when identified by our algorithm. The descending triangle pattern has a success rate 74% on the 1H chart for all pairs generated by our algorithm.

We will be shorting this pair approximately 20 pips below the bottom of the triangle. Our profit target will be 150-180 Pips. Stops will be placed 60-100 Pips.

Sunday, August 2, 2015

New GBPJPY Signal

As of 08/02/2015 @ 20:30 EST:

The Global Currency Scalper has identified a long opportunity in GBPJPY.

We will be buying some GBPJPY at market with a price target of 194.700 while risking 100 Pips. This pair is forming an Ascending Triangle which on the 4H chart has produced 75% chance of hitting our projection. Our algorithm has produced 69% odds on GBPJPY when giving a signal. Total odds for this trade will be approximately 72% odds of hitting the target.

Monday, July 13, 2015

New Signal Buy EUR/JPY

As of 07/13/2015 @ 10:35 EST:

The Global Currency Scalper has identified a Gartley pattern in the process of being formed in EUR/JPY pair. Gartley patterns are to be traded at point D but with the Greek deal and our algorithm giving a buy signal we will trade this pair from the long side while the Gartley is being formed.

We will be going long at market or any price under 136.400, our stop will be 134.600 and our forecast will be 139.900.

Monday, June 22, 2015

New Signal USD/JPY

As of 06/22/2015 @ 22:20 EST:

USD/JPY is an uptrend over the past year and although we expect a period of consolidation this pair is one to watch. A breakout of this consolidation period, one way or the other will warrant action.

We will be taking a long position with a break of 124.170 or a short position with a break of 122.330. Either position will have a risk of approximately 180 Pips. Targets will be 150 - 200 Pips.

New Signal AUD/USD

As of 06/22/2015 @ 21:54 EST:

The Australian Dollar may be readying to turn lower against its US counterpart after prices put in a bearish Three Inside Down candlestick pattern. A daily close below 23.6% Fibonacci expansion at 0.7715 exposes the 38.2% level at 0.7632. Alternatively, a reversal above the 14.6% Fib at 0.7766 clears the way for a test of the 0.7813-18 area.

We will be taking a short position with a break of 0.76900 or conversely taking a long position with a break of 0.77760. Both will have a stop of approximately 85 Pips.

New Signal GBP/USD

As of 06/22/2015 @ 21:15 EST:

The British Pound advanced against the US Dollar as expected but a bearish Evening Star candlestick pattern hints a turn lower may now be ahead. Near-term support is at 1.5794, the 50% Fibonacci expansion, with a break below that on a daily closing basis exposing the 38.2% level at 1.5647. Alternatively, a turn above the 61.8% Fib at 1.5941 clears the way for a test of the 76.4% expansion at 1.6124.

We will be taking a short position with a break below 1.57800 with a stop of 1.59400, conversely we will be taking a long position with a break of 1.59500 with a stop of 1.57830.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

uk,

wall street

Thursday, June 18, 2015

New Signal USD/CAD

As of 06/18/2015 @ 22:30 EST:

The Global Currency Scalper has identified that USD/CAD is forming nice Gartley pattern on the 4H chart.

This pair is setting up nicely for a Gartley pattern which may complete down at level D. Since level C was somewhat shallow we have increased the D level as sellers may have more control over buyers in the short-term. We will be buyers around 1.20400 with a stop-loss of 140-150 Pips. If level D holds true to form we could see a bounce of 200-300 Pips.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

uk,

wall street

Monday, June 15, 2015

New GBP/USD Signal

As of 06/15/2015 @ 21:53 EST:

The Global Currency Scalper has recognized GBP/USD is forming nice AB=CD pattern on the 4H chart.

This pair has exceeded its C target setting the stage for a move to point D which will at least 100% of the A-B move. The B-C move should never exceed 78.6% of A-B, with that said we will set a stop of 100 Pips which will be slightly more than the 78.6% threshold. It's very well possible point D stretches to 1.272%, 1.382%, 1.618%, or even 2.618% of the A-B move. We will trade it conservatively and exit near the 100% level of 1.51700.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

trading,

uk,

wall street

Tuesday, June 2, 2015

New Correlation Signal EUR/GBP & EUR/JPY

As of 06/02/2015 @ 18:02 EST:

The Global Currency Scalper will be taking the following trade: Long EUR/GBP & Short EUR/JPY.

A nice correlation trade is setting up between EUR/GBP & EUR/JPY. The spread in the correlation is currently 400 Pips, over the past year the max spread has been approximately 500 Pips. This pair has a correlation of 70% over the past year and 88% over the past 6 months.

We will be taking 1/2 our intended position size, if the spread continues to widen we will slowly add to our position. There is a good chance we see that happen over the next few days as the Great Britain, Eurozone & Japan all have economic news scheduled this week. If our timing happens to be accurate and the spread begins to narrow before that data is released we will book our profit.

*Remember 1 Pip move EUR/GBP is equivalent to 1.5 Pips so you must reduce your size in EUR/GBP.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

uk,

wall street

Wednesday, May 20, 2015

New Correlation Trade CAD/JPY to GBP/JPY

As of 05/20/2015 @ 19:22 EST:

The Global Currency Scalper is taking the following trade: Long CAD/JPY & Short GBP/JPY

The correlation between these two pairs is 77% over the past year. The widest the spread has got over that time is about 800 Pips. Currently these two pairs are 620 Pips apart. The GBP/JPY has enjoyed a nice run-up lately which may be stretched, bumping up against some near term resistance.

With that said we will be entering 1/2 our intended position size with the intentions of easing into the second half if the spread widens significantly. We expect to see this spread narrow over the coming days/weeks. If it happens before we can put our entire position on we will feel comfortable closing out the position with a profit of any amount.

Tuesday, May 19, 2015

New Correlation Between GBP/USD & AUD/USD

*Position Update: The Global Currency Scalper closed this correlation trade with a profit of 196.7 Pips.

As of 05/19/2015 @ 19:35 EST:

The Global Currency Scalper will be placing the following trade: Short GBP/USD & Long AUD/USD.

A nice correlation trade is setting up between GBP/USD & AUD/USD. The spread in the correlation is currently 450 Pips, over the past year the max spread has been approximately 500 Pips.

We will be taking 1/2 our intended position size, if the spread continues to widen we will slowly add to our position. There is a good chance we see that happen over the next few days as the US, Great Britain & Australia all have economic news scheduled for release. If our timing happens to be accurate and the spread begins to narrow before that data is released we will book our profit.

Monday, May 18, 2015

New Correlation CAD/JPY & GBP/JPY

*Position Update: As of 05/19/2015 @ 7:33 EST The Global Currency Scalper closed out both sides of this correlation trade with 112.2 Pips.

As of 05/18/2015 @ 8:55 EST:

The Global Currency Scalper will be taking the following trade: Long CAD/JPY & Short GBP/JPY

The correlation between these two pairs is 77% over the past year. The widest the spread has got over that time is about 800 Pips. Currently these two pairs are 600 Pips apart. The GBP/JPY has enjoyed a nice run-up lately which may be stretched, bumping up against some near term resistance.

With that said we will be entering 1/2 our intended position size with the intentions of easing into the second half if the spread widens significantly. We expect to see this spread narrow over the coming days/weeks. If it happens before we can put our entire position on we will feel comfortable closing out the position with a profit of any amount. Keep in mind there is a national holiday in Canada today with its banks closed.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

uk,

wall street

Thursday, May 14, 2015

New Correlation Trade EUR/USD & GBP/USD

*Position Update: As of 05/15/2015 @ 7:41 EST The Global Currency Scalper liquidated both sides of this correlation trade with a profit of 28.6 Pips.

As of 05/14/2015 @ 12:03 EST:

The Trade: Long EUR/USD & Short GBP/USD

The correlation between these two pairs is 96% over the past year. The widest the spread has got over that time is about 700 Pips. Over the past 18 months we saw the spread widen to approximately 800 Pips. Currently these two pairs are 700 Pips apart.

With that said we will be entering 1/2 our intended position size with the intentions of easing into the second half if the spread widens significantly. We expect to see this spread narrow over the coming days/weeks. If it happens before we can put our entire position on we will feel comfortable closing out the position with a profit of any amount.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

uk,

wall street

Wednesday, May 13, 2015

New Signal AUD/USD

As of 05/13/2015 @ 20:53 EST:

The trade Buy AUD/USD @ 0.80750

AUD/USD is sharply higher breaking the 0.80760 top from April 29th and extends the recovery from the lows set last week and during the month of April. Since mid April this pair has been putting in higher lows and we believe this trend will continue.

We are looking for AUD/USD to test the top trend line of the reverse triangle and will be buyers ahead of this level. Bidding 0.80750 with a targets of the figure 0.82000 and ultimately 0.82950 which is the YTD high set in January. A stop will be placed at 0.78400 which will be raised as the days go by and the higher lows trend-line is followed.

Our Unique Forex algorithm is making the same prediction with a probability of 93%.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

uk,

wall street

Monday, May 11, 2015

New Correlation Trade GBP/USD & NZD/USD

*Position Update: As of 05/13/2015 @ 23:38 The Global Currency Scalper liquidated its position with a loss of 19 Pips.

As of 05/11/2015 @ 8:50 EST:

The Global Currency Scalper will be taking the following correlation trade. Short GBP/USD & Long NZD/USD.

A nice correlation trade is setting up between GBP/USD & NZD/USD. The spread in the correlation is currently 500 Pips, over the past year the max spread has been approximately 700 Pips.

We will be taking 1/2 our intended position size, if the spread continues to widen we will slowly add to our position. There is a good chance we see that happen over the next few days as the US & Great Britain both have economic numbers scheduled for release. If our timing happens to be accurate and the spread begins to narrow before that data is released we will book our profit.

Wednesday, May 6, 2015

New Correlation Trade AUD/USD & AUD/NZD

*Position Update: As of 05/13/2015 @ 23:38 The Global Currency Scalper liquidated its position with a gain of 28.0 Pips.

As of 05/06/2015 @ 18:50 EST:

The trade: Long AUD/USD & Short AUD/NZD.

The Global Currency Scalper is seeing a nice correlation trade setting up between AUD/USD & AUD/NZD. The spread in the correlation is currently 300 Pips, over the past year the max spread has been approximately 600 Pips.

We will be taking 1/2 our intended position size, if the spread continues to widen we will slowly add to our position. There is a good chance we see that happen over the next few days as the US & Australia both have unemployment numbers scheduled for release, with Australia's in the next few hours. If our timing happens to be accurate today and the spread begins to narrow before that data is released we will book our profit.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

uk,

wall street

New Correlation Signal USD/CAD & USD/JPY

*Position Update: On 05/06/2015 @ 14:58 The Global Currency Scalper liquidated both sides of the correlation trade with a profit of 79.1 Pips.

As of 05/06/2015 @ 11:36 EST:

The trade: Long USD/CAD & Short USD/JPY.

A nice correlation trade is setting up between USD/CAD & USD/JPY. The spread in the correlation is currently 600 Pips, over the past year the max spread has been approximately 1,200 Pips.

We will be taking 1/4 our intended position size, if the spread continues to widen we will slowly add to our position. There is a good chance we see that happen over the next few days as the US & Canada both have unemployment numbers scheduled for release. If our timing happens to be accurate today and the spread begins to narrow before that data is released we will book our profit.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

uk,

wall street

Monday, May 4, 2015

New Correlation Trade AUD/JPY & CAD/JPY

*Position Update: As of 05/05/2015 at 00:36 EST The Global Currency Scalper liquidated both sides of the correlation trade with a profit of 73.1 Pips.

As of 05/04/2015 at 21:42 EST:

A nice correlation trade is setting up between AUD/JPY & CAD/JPY. The spread in the correlation is currently 200 Pips, over the past year the max spread has been approximately 400 - 450 Pips.

We will be taking 1/2 our intended position size, if the spread widens to that max spread mentioned above we will add the second 1/2. Australia is announcing interest rates in 3 hours which could provide that opportunity or present us with a profit. The trade is Long AUD/JPY & Short CAD/JPY.

Sunday, May 3, 2015

New Correlation Between USD/SGD & USD/JPY

*Position Update: As of 05/03/2015 @ 23:23 EST The Global Currency Scalper closed its correlation trade with a profit of 27 Pips.

As of 05/03/2015 @ 19:39 EST:

The trade: Long USD/SGD and Short USD/JPY.

The Global Currency Scalper will be initiating a position in a correlation trade between USD/SGD & USD/JPY. As you can see the correlation has widened to approximately 500 Pips but over the past year we have seen these pairs spread as wide as 650 Pips. With that said we will slowly build into our position, initiating 50% of our ultimate size. If the spread continues to widen this will give us an opportunity to lower our cost basis. If the current width of the spread happens to become the max over the next few days or weeks we will still participate by having our 50% position.

Trading a correlation strategy greatly reduces any directional risk one takes when taking a normal long or short position. Over the past year this pair has an 93% correlation which gives us great odds of having a profitable trade. Proper money management combined with solid odds gives you staying power in the trading business.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

uk,

wall street

Wednesday, April 29, 2015

New Signal USD/JPY & USD/CAD

*Position Update: At 04/29/2015 @ 23:07 EST The Global Currency Scalper liquidated 75% of the correlation trade between USD/JPY & USD/CAD. The USD/CAD long was closed at 1.20260 picking up 12.6 Pips and the USD/JPY short was closed at 118.733 for a profit of 20.7 Pips giving us a total of 33.3 (24.9) Pips of profit. We will hold 25% of our position while the correlation narrows over time.

As of 04/29/2015 @ 20:30 EST:

The Global Currency Scalper has identified a possible opportunity in a correlation trade between USD/JPY and USD/CAD. The trade: Long

USD/CAD and Short USD/JPY.

We will be initiating a position in a correlation trade

between USD/JPY & USD/CAD. As you

can see the correlation has widened to approximately 450 Pips but over the past

year we have seen these pairs spread as wide as 1,200 Pips. With that said we will slowly build into our

position, initiating just 25% of our ultimate size. If the spread continues to widen this will

give us an opportunity to lower our cost basis.

If the current width of the spread happens to become the max over the

next few days or weeks we will still participate by having our 25%

position. This evening we will get the

interest rate decision from the Bank of Japan which may present an opportunity

to add to our position.

Trading a correlation strategy greatly reduces any

directional risk one takes when taking a normal long or short position. Over the past year this pair has an 87%

correlation which gives us great odds of having a profitable trade. Proper money management combined with solid

odds gives you staying power in the trading business.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

uk,

wall street

Tuesday, April 28, 2015

New Correlation Trade In AUD/JPY & EUR/JPY

*Position Update: As of 04/28/2015 @ 23:11 The Global Currency Scalper liquidated 75% of its correlated trade between AUD/JPY & EUR/JPY with a profit of 32 Pips. We will be holding 25% of the position for the remainder of the closing of the correlation gap.

As of 04/28/2015 @ 19:05 EST:

The Global Currency Scalper is taking a correlation trade between AUD/JPY & EUR/JPY. As you can see over the past year the correlation has fluctuated quite a bit, even crossing at times exchanging the lead. Currently AUD/JPY has taken the lead over EUR/JPY and the spread in the correlation has widen to approximately 500 pips. Throughout the past year, the widest the spread has become 500 - 600 pips.

The Global Currency Scalper will be taking 1/2 of a position by going Long EUR/JPY and Short AUD/JPY. With news slated to come out of New Zealand this evening and the Fed meeting on Wednesday the spread could widen to 600 or slightly more pips enabling us to add to our position. If the spread starts to narrow we will see a nice profit without taking much directional risk.

Labels:

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

uk,

wall street

Monday, April 27, 2015

New Correlation Signal AUD/USD & GBP/USD

*Trade Update: The Global Currency Scalper took 1/2 its position with a long in AUD/USD @ 0.78693 and a short in GBP/USD @ 1.52212. We covered the positions at 0.79975 & 1.53197 respectfully picking up 29.7 Pips on 75% of our 1/2 size position. We will be holding the remaining 25% while the correlation continues to narrow.

As of 04/27/2015 @ 22:45 EST:

The Global Currency Scalper is watching and taking half a position in a correlation trade between AUD/USD & GBP/USD.

In the chart above you will see AUD/USD is the candlesticks, GBP/USD is the blue line and the yellow line is EUR/USD. We will be ignoring EUR/USD for this trade. The correlation we are targeting is exclusively between AUD/USD & GBP/USD. As you can see during the past year the correlation between the two fluctuates between trading in parity to spreads as wide as 600 Pips.

Today this spread is approximately 200 Pips therefore we will be initiating 1/2 our position, this will allow us to get involved in the trade while waiting for the spread to widen. Our position will be LONG AUD/USD and SHORT GBP/USD. If we see a spread of 300 pips or more we will add the second half of our position. If the spread narrows from our entry we will take the profit and move on to another trade.

This trade does not present the amount of risk a directional trade does and allows us to profit when the correlation narrows, and it will narrow. Patients is needed with these trades and the Global Currency Scalper recommends not using high leverage as these trades can take many days or even a couple of weeks to work themselves out. Not using high leverage will allow you to take your traditional directional trades while holding a correlation position.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

uk,

wall street

Sunday, April 26, 2015

New Signal NZD/USD

As of 04/26/2015 @ 21:30 EST

The Global Currency Scalper is watching NZD/USD for a potential big move, favoring the downside. As you can see from the chart above this pair has been in a downtrend since August of 2014 although recently a bid has been found, indicated by the higher lows being set since early March of 2015.

The NZD/USD has also been setting lower highs as shown by the green line, these tops could prove to be too much to overcome and enable the shorts to prevail. As the two trend-lines converge they are getting closer in distance, setting up for a powerful move. The Global Currency Scalper is favoring the short side for this trade but we will be prepared to act with a breakout to the upside as well.

We have set alerts just below the green line and just above the red line to give us a price warning. The Global Currency Scalper will be looking for a close below the red line or above the green line before taking action. Since we are favoring a short trade we would like to see this pair close below 0.75500 as of today but as the days go by this price will rise along the red trend-line.

Also giving us confidence for a short trade is from the Fibonacci levels as shown on the chart below. As you can see this pair has retraced to the 38.2% level and has failed to maintain price action above it. The NZD/USD has recently fallen from this Fibonacci level and could attempt to rollover in the coming days. We could be in for a wait of a few days to a week or more as the apex on these charts in not until mid-May 2015. But as these two lines converge the battle between buyers and sellers will eventually be won by either side creating a potentially strong move. We could potentially see a 300 - 400 pip move.

The Global Currency Scalper will be looking to short with a close below 0.75500 with a stop of 0.77450 and a forecast of 0.71600. As mentioned above we will also be open to taking a long position as soon as we get a close above the red trend-line.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

nyc,

options,

pips,

shanghai,

stock market,

stocks,

trading,

uk,

wall street

Subscribe to:

Comments (Atom)