We are Global Currency Scalpers, bringing you one of our three successful trading strategies. Centered on scalping of the Forex market. We realize that 65% of Forex traders lose money, some estimate it's as high as 90% of Forex traders lose money. At Global Currency Scalper we run three very successful and time proven trading strategies. This blog is intended to bring you one of those strategies with live Scalping updates. Don't be one of the Forex markets statistics!

Tuesday, December 30, 2014

New Signal EUR/AUD

*Trade Update as of 01/01/2015 @ 19:09 EST: The Global Currency Scalper liquidated our position in EUR/AUD at 1.47700 with a gain of 51.9 Pips.

As of 12/30/2014 @ 19:56 EST:

We have identified EUR/AUD as a short candidate as this pair is starting to roll over on the daily chart. A look at the weekly will show a head and shoulders pattern developing with some downside bias, If you look further out to the monthly chart you will see the longer-term trend is to the downside.

The Global Currency Scalper likes to see that the EUR/AUD has broken its short-term up channel trend on the daily chart, followed by a period of consolidation which cracked to the downside earlier today. We will be taking a short trade if this pair takes out the 1.48220 level. The Global Currency Scalper is forecasting a move to the 1.47400 level which could eventually see a move down to the figure of 1.47000. A stop will be placed at 1.49600. If EUR/AUD were to take out this level prior to initiating a position then our view will turn neutral and further assessment of this pair will be needed.

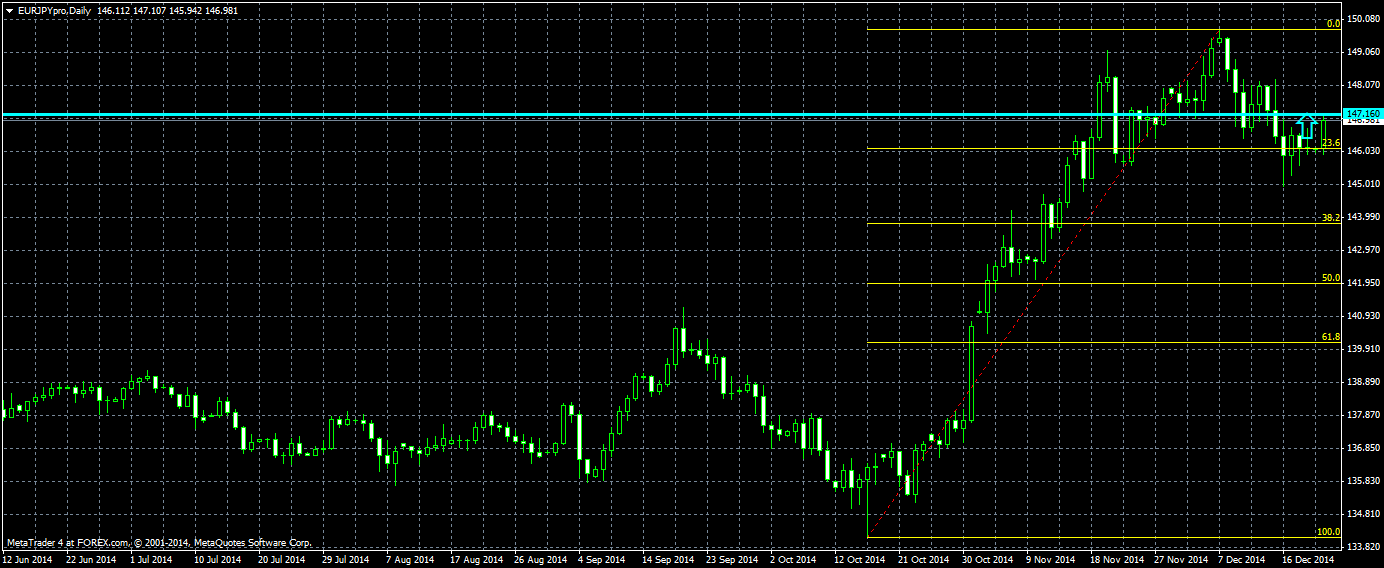

New Signal EUR/JPY

*Signal Update as of 01/02/2015 @ 8:43 EST: The Global Currency Scalper has cancelled its open order on EUR/JPY as trade conditions have changed.

As of 12/30/2014 @ 8:12 EST:

We have identified EUR/JPY as a potential trend reversal short trade. This pair has been in an uptrend on the daily and weekly charts but is showing signs of rolling over. Initially trying hold and bounce off the 23.6% Fibonacci retracement level but after a consolidation period it has begun to breakdown. Could this be the start of a new trend?

With some support levels below the Global Currency Scalper would like to see these levels broken before initiating a position. Shorts will be taken on a break of the 144.400 level, targets of the figure 144.000, 143.350 and then further down to the 142.150 level. Stops will be placed at 146.500, if this level is taken out prior to initiating our position the Global Currency Scalper's opinion will change to neutral with further evaluation to be given.

Monday, December 29, 2014

New Signal USD/SGD

*Trade Update as of 01/02/2015 @ 8:39 EST: The Global Currency Scalper has liquidated its USD/SGD position with a gain o 12.8 Pips. We initially went long at new year highs which is risky enough, the pair did not run too hard to the upside and we have manufacturing data coming out at 10:00 EST. We prefer to book the profits and move to cash for the weekend.

As of 12/29/2014 @ 21:19 EST

We have identified USD/SGD as a long trade potential with significant upside potential. On the daily chart above you can clearly see this pair is in an uptrend. We traded it earlier this month after a bounce off the 23.6% Fibonacci level. Further research will show USD/SGD is preparing to make a multi-year high if it can take out the 1.32539 level. Taking a look at the monthly chart below you will see this pair has made a significant move off the low set in 2011 and has proceeded to make higher highs while basing. Again sighting the 1.32539 level, if this barrier can be taken out on the monthly chart there is a clear path to 1.34470.

The Global Currency Scalper will be buyers of USD/SGD if prices can take out 1.32700 and will be targeting the figure of 1.33000, then 1.33450 and eventually the 1.34470 level stated above. We suggest taking profits at any level on the way up, all price action and fundamentals are indicating these levels can be reached. We will be placing our stop at 1.31800, if this level is breached before a position can be initiated then the Global Currency Scalper will change its view on this pair to neutral.

Labels:

Bloomberg,

business,

currency,

economy,

euro,

finance,

Forex,

hedge funds,

investing,

music,

news,

options,

pips,

stock market,

stocks,

trading,

uk,

wall street

Sunday, December 28, 2014

New Signal GBP/JPY

*Signal Update: The Global Currency Scalper has cancelled its open order of GBP/JPY as this pair breached 186.400 before initiating a position at our purchase price.

As of 12/28/2014 @ 22:10 EST

We have identified a possible long trade in GBP/JPY. This pairs overall trend on the Daily, 4 hour and 1 hour charts has been up and it recently experienced a pullback which held the 38.2% Fibonacci retracement level.

Recent action in the GBP/JPY saw a tight consolidation after the bounce off the 38.2% level mentioned above. The Global Currency Scalper is anticipating a breakout of this consolidation and target higher prices.

We will be purchasing GBP/JPY at the 187.935 level with an initial target of 189.200 with the possibility of seeing 189.650 as well. Our stops will be set in the vicinity of 186.400, any breach of this level will turn the outlook from the Global Currency Scalper's to a neutral position.

Monday, December 22, 2014

New Signal EUR/JPY

*Trade Update as of 12/24/2014 11:43 EST: The Global Currency Scalper has canceled its order as we have approached the Christmas holiday and will not be in the office. We will not be taking any new positions.

As of 12/22/2014 11:44 EST:

We have identified EUR/JPY as a long candidate. With the daily chart in an overall uptrend, the 1 & 4 hour charts showing the uptrend is getting ready to resume we would like to buy this pair if it takes out the 147.160 level.

The EUR/JPY has, for the most part, held the 23.6% Fibonacci retracement level and with the strong action seen so far this morning this pair looks to be getting ready to move higher. This pair seems to have already started a new overall move to the upside, we would just like to see it take out the level mentioned above before initiating a position. This new move has the potential to reach the 148.400 level.

The Global Currency Scalper will take a long position if the 147.160 level is taken out, looking for a move to at least close to the figure of 148.000 and a stop will be set at 145.460. If the stop level is reached prior to taking out the 147.160 level our view will change to neutral on this pair.

Sunday, December 21, 2014

New Signal USD/JPY

*Trade Update as of 12/23/2014 @ 9:13 EST: The Global Currency Scalper is out of USD/JPY around 120.725 picking up 57.4 Pips.

As 12/21/2014 @ 20:41

We have identified USD/JPY as a possible Buy @ 120.150 or higher. As you can see on the daily chart the long-term trend is bullish with a recent minor pullback to the 23.6% Fibonacci retracement level. With a strong bounce off this level the uptrend remains intact.

The Global Currency Scalper believers buyers are ready to step back in over the coming days to push this pair up to the 121.000 level with higher targets set around 121.850. This move would threaten the yearly high with a possible break pushing USD/JPY into new territory.

We will set out stops around the support level of 118.820. If this level is breached prior to establishing our position then the bullish view will turn neutral until further price action can confirm a re-entry signal.

Thursday, December 18, 2014

New Signal EUR/JPY

Trade Update: As of 12/18/2014 @ 20:07 The Global Currency Scalper liquidated its position picking up 17.6 Pips. This pairs current ranging action could be viewed as a struggle, we don't want to wait to see who will win this battle.

As of 12/18/2014 @ 16:23

We have identified EUR/JPY as a potential long candidate. On the daily chart you will notice the strong rally since Oct 17th and a recent pullback to the 23.6% Fibonacci level. Over the past couple of days it tried to breakdown through that level only to find buyers.

The Global Currency Scalper will be taking a long position at 145.960 with a stop of 145.150 and a target of 147.00 to 147.250 level. If the later level is taken out we may see this pair rally as high as 150.000. If EUR/JPY trades down to our stop of 145.150 we will shift to a more neutral stance.

Wednesday, December 17, 2014

New Signal USD/SGD

*Trade Update: The Global Currency Scalper liquidated the USD/SGD positions around 1.31810 picking up a profit of approximately 16 Pips.

As of 12/17/2014 @ 19:30

We have identified a long opportunity in USD/SGD. As you can see from the daily chart above the overall trend is to the upside and with the FOMC announcement out of the way this pair is poised to move higher over the next few hours, possibly a day or two.

A strong reversal from this weeks shallow pullback held the 23.6% Fibonacci level showing signs of strong buying interest. This recovery is putting 1.31380 to 1.31550 resistance in focus and if broken by 10 - 15 Pips could see a move higher to 1.32400 target.

The Global Currency Scalper will continue to have an upward bias unless prices fall below the 1.29900 level. We will be looking to go long if the USD/SGD can take out the 1.31650 level.

Tuesday, December 16, 2014

New Signal AUD/JPY

*Trade Update 2: As of 12/16/2014 @ 23:16 we covered the remaining piece of our position at 95.266 for 58.2 Pips gain.

*Trade Update: As of 12/16/2014 @ 22:07 we covered 1/2 our position for a 43 Pips gain, moving the stop to break-even on the remaining position.

As of 12/16/2014 @ 19:43

We have identified AUD/JPY as a short candidate on the daily chart. Looking at the 1 & 4 hour charts will yield the same downtrend, confirming our view.

Another strong decline during the last session saw the 61.8% Fibonacci retracement taken out easily and AUD/JPY should be poised to move lower targeting 94.850 and 94.540. Any trade in this pair should be on the short side as long as 96.970 resistance is not taken out, if so we will then view this pair in a more neutral light.

The Global Currency Scalper will be looking to short AUD/JPY if the 61.8% Fibonacci retracement is take out again by 10 - 15 Pips. We will be executing our short at 95.850 or lower to confirm the retracement level break. Stops will be set at the resistance mentioned above with profit targets around the figure of 95.000

New Signal USD/CAD

*Trade Update: As of 12/16/2014 22:38 The Global Currency Scalper is canceling our order as we do not want to be stuck in a position heading into the FOMC meeting on 12/17/2014.

As of 12/16/2014 11:12 EST:

We have identified USD/CAD as a possible long trade. The trend of the 1 hour, 4 hour and daily chart is clearly to the upside. Looking deeper into the 1 hour time-frame you can see this pair had broken its channel and traded above it for several hours on 12/15/2014. It has since pulled back into its channel and is continuing to trade sideways.

The Global Currency Scalper is expecting the USD/CAD uptrend to resume and are looking to go long at or above 1.16485 with targets up near the figure of 1.17000. The near-term support comes in at 1.15910 and if broken we will turn neutral on this pair.

Monday, December 15, 2014

New Signal GBP/AUD

*Trade Update: We are out of this position as GBP/AUD approached the figure of 1.91000 picking up 36.3 Pips.

As of 12/15/2014 19:48 EST:

We have identified a Long Scalp trade in GBP/AUD with an entry of 1.90578 of higher. This is our second signal for this pair today. The Global Currency Scalper if looking for GBP/AUD to break its short-term down trend-line and reestablish its longer-term uptrend.

With the RBA making the following announcements from its minutes: "repeats most prudent course is period of stability in interest rates" and "more AUD depreciation likely needed to achieve balanced growth" we feel the GBP/AUD is primed to rally. This rally will only resume once that short-term downtrend line is broken by 5 - 15 Pips.

Stop will be set at 1.89650 with forecast targets of the 23.6% Fibonacci line 1.90679, 1.90918, 1.91031 as well as the 1 hour chart top.

New Signal GBP/AUD

*Trade Update: The Global Currency Scalper scalped the trade for 12.6 Pips, we are fully out of the position.

As of 12/15/2014 @ 8:24 a.m. EST:

We have identified GBP/AUD as a long candidate with a purchase price of 1.90874 or higher. The long-term trend on the 1 hour chart is bullish as well as the 4 hour and daily. The pair has had a small pullback which bounced off the 38.2% Fibonacci level maintaining its long-term uptrend.

The Global Currency Scalper would like to see GBP/AUD clear its small pullback trend-line by 5 to 15 pips before entering a position. A long trade could easily see a rally to the figure of 1.91000 for a quick scalp. If that level is cleared the next stop could be 1.91240 before ultimately challenging the 1 hour high of 1.91651.

Our stop level would be set at 1.89650 so please set your trading size accordingly.

*PRICE UPDATE: entry has been changed to 1.90775 or higher as of 12/15/2014 @ 9:05 a.m. EST.

Subscribe to:

Posts (Atom)